BNG Finder: A Year in Review

2025 was a year of change and uncertainty for the Biodiversity Net Gain (BNG) Market. Despite it being BNG's first full calendar year of being a regulatory requirement, there has been caution amongst developers, landowners and the wider industry as the sector awaited outcomes of Government consultations.

Following the announcement at the end of 2025 that exemptions will apply to smaller sites of up to 0.2 hectares, it is recognised that while this change avoids a more severe impact on the BNG sector, it does still represent a setback for nature recovery and for incentivising private investment in nature markets. The government has, however, stated its intention to make offsite BNG easier to deliver, which will be critical to achieving nature restoration at a national scale. How this commitment is translated into practice over the coming year will therefore be of particular interest.

Despite this, clarity from the announcement has brought some stability back into the market, and with the potential inclusion of NSIPs into BNG regulation this year, there are new opportunities on the horizon to be excited about.

This is the first full year that our BNG Finder team have published the BNG Dashboard, which provides open insights into how the BNG Market is evolving.

As the year has come to a close, some of the key trends and highlights are:

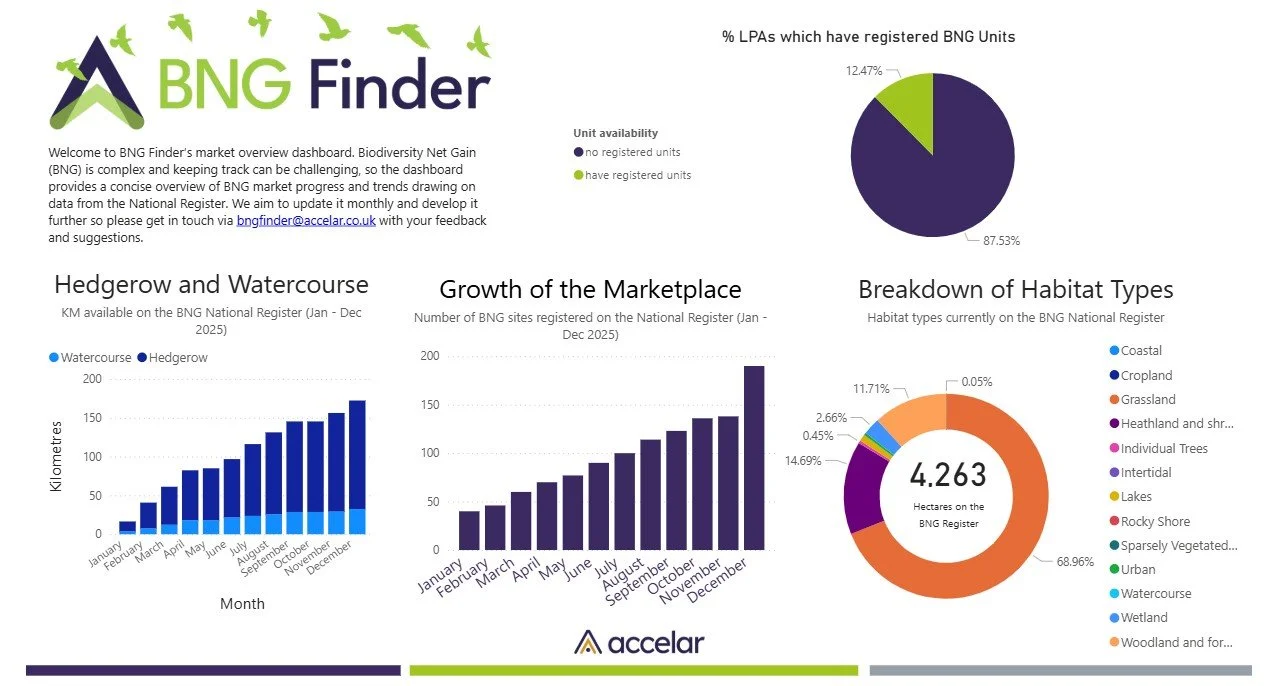

✅300% increase in registered BNG units since January 2025

✅190 total registered BNG sites

✅4,263 hectares of land have been registered for BNG as of the start of January 2026

✅96% of BNG units are habitat units, the majority being grassland (69%), followed by heathland (14.7%) and woodland (11.7%) units.

✅Over 12% of LPAs are currently registered with BNG units

We asked our Accelar colleagues, Nina Hees, Senior Sustainability Consultant and Chris Fry, Managing Director, to reflect on the past year in BNG, and how they see the future evolving.

Why is BNG such an important planning regulation?

Nina: Development is inevitable, and as we have already stripped England of much of its wildscapes, aligning the two to ensure not only no net loss, but net gain for nature, is critical.

Mandated BNG policy addresses the UK's nature decline by enhancing ecosystems, and given the way the metric is set up, it helps encourage habitat corridors and networks, enhancing fragmented habitats, and connecting us to nature. And you might ask - well why is biodiversity important? That's a question for another time, but in essence biodiversity underpins so much!

What sets BNG apart as a market mechanism?

Nina: BNG puts the mitigation hierarchy into action - principles which are already embedded in global frameworks and agreements (For example, Environmental Impact Assessments, CSR standards, the Kunming-Montreal Global Biodiversity Framework).

Additionally, BNG provides a measurable mechanism and accounting method to flow private finance into nature and, being backed by government, provides more security. It creates a regulatory market - one which encourages adequate supply, demand, and accountability. Importantly, it brings together ecologists, developers, local government, landowners, NGOs, and investors within one framework - something that doesn't always happen in nature conservation.

What's also exciting is that it is one of the more advanced, mandated global biodiversity markets, one which sets a precedent for other nations who may approach similar systems, and a mechanism to learn from.

“It is one of the more advanced, mandated global biodiversity markets, one which sets a precedent for other nations.”

How have you seen the evolution of the BNG market in the past year?

Nina: If I consider 2024 to 2025, the BNG market has transitioned from a theoretical policy framework to a live, growing market. Since early 2025, scaling has been rapid with the increasing uptake of habitat banks and BNG-dedicated land. Currently, supply is generally outstripping demand, especially for easier to establish habitats like grasslands. There is a risk that England turns into a monoculture of 'other neutral grassland' - so to speak. However, demand and pricing is strongest for rare or harder to replace habitats (For example, water related units, higher distinctiveness habitats) and I expect that to continue, especially where those units are hard to source locally.

Chris: The completion of many Local Nature Recovery Strategies around the country in 2025 is also positive for informing where and what kinds of offsite habitat creation and enhancement can achieve the greatest impact.

How are Accelar & BNG Finder driving the BNG market?

Chris: We recognised that the BNG market was complex and wanted to play our part in helping our clients large and small, on the supply side as well as developers and infrastructure bodies, to navigate it successfully. BNG Finder is in a unique position firstly as it is a curated service that recognises that different parties will have different priorities (to achieve social, climate or other environmental co-benefits from high integrity offsite BNG provision).

Nina: Also, we are providing the service as an extension of our advisory work to help to accelerate the green transition. That means we have insight into the supply and project development side through our work with farmers and land managers like nature conservation charities, as well as the demand side through our engagement and contacts with buyers of units and investors. We also monitor unit prices, trades etc. and model BNG revenue/ cost for projects so have insight into where the risks lie and what a project could look like over 20-30 years. We have an adaptive business model, which is important given an evolving policy landscape. We can respond to changes in regulation, price and support clients in this.

How do you see the impact of the recent small development exemption on the evolution of the BNG market, and on nature more widely?

Nina: Whilst there are benefits to making the system more efficient and lowering costs by limiting exemptions to very small sites, we may miss out on some private-sector investment that would otherwise go to nature. In the current market, demand for small sites account for most of the BNG demand. With the small sites exemption, I would expect a reduction in private sector demand for smaller, fractional units, which could affect the speed or viability of some nature restoration projects. And, from nature's perspective, everything is connected and small contributions can add up!

“The expansion of the BNG mandate to Nationally Significant Infrastructure Projects (NSIPs) is likely to be a significant demand trigger.”

What is exciting about the next year or few years in BNG?

Nina: The expansion of the BNG mandate to Nationally Significant Infrastructure Projects (NSIPs) is likely to be a significant demand trigger. I'm also curious about the shift towards digital BNG. Moving away from Excel can make the system more transparent and efficient to navigate but may also come with its own challenges.

Chris: The expansion of BNG into NSIPs arises at a time when the UK’s pipeline of investment in infrastructure projects is rising again. The National Infrastructure and Service Transformation Authority (NISTA) was formed last April and has already published a new 10 Year Infrastructure Strategy that is backed by at least £725 billion of government funding. Whether associated with NSIPs or slightly smaller scale asset upgrade projects, the potential demand for offsite BNG has already been illustrated in lots of recent procurement exercises by utility companies.

Concluding Remarks

As we head into BNG’s second full year, and emerging shifts to the regulatory landscape come into play, BNG Finder will continue to monitor and report on how the market evolves. Stay up to date by following us on the BNG Finder LinkedIn, checking our dashboard for its monthly updates, and feel free to get in touch with our team via bngfinder@accelar.co.uk.