Insight: A deep dive into the 2023 Green Finance Strategy

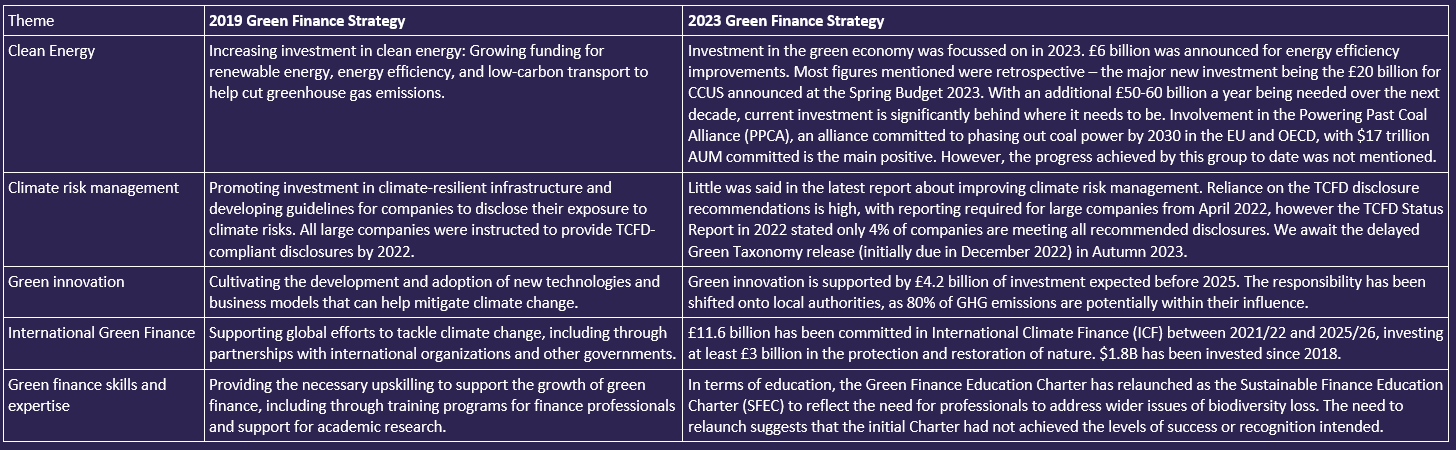

The updated Green Finance Strategy was released on the 30th March 2023, presenting a key opportunity to direct public and private funding into critical areas, aligning with the Paris agreement made in 2015 and national net zero targets. Whilst the dust settles on some of the key outcomes identified, Accelar has performed a deep dive to assess some of the underlying themes and commitments.

New Green Finance Strategy shows that there is still much work to be done

The first Green Finance Strategy released in 2019 focused on transitioning to a low-carbon economy, shifting the financial system to one that fully integrates climate and environmental risks into all decisions. The Strategy aimed to accelerate financial support for delivery of the UK’s carbon targets, resilience ambitions and clean growth. The Green Finance Institute (GFI) was subsequently established to accelerate the transition to a zero-carbon and climate-resilient economy by mobilising capital, expertise, and innovation towards sustainable finance. We’ve taken a look at some of the updates to these objectives in the 2023 Strategy.

Carbon removal and nature get more attention than emissions reduction

Some of the key words within the 2023 Strategy are highlighted in the word cloud, which provides some indication of the more prominent themes. One main finding is the focus on technology, with hydrogen and carbon capture jointly mentioned 2x higher than the mentions for carbon reduction measures (e.g. less use of fossil fuels, retrofit, energy efficiency).

The frequency of nature based terms is promising, with focus on nature finance and the mitigation offered by natural developments. The nature finance sector is continuing its rapid development throughout this year, for example with the TNFD framework due for release in September 2023 [1]. This is complimented by the latest Nature Markets framework [2], and the various commitments for high integrity markets.

Graph showing current Government investment into selected low-carbon growth areas against expected total investment required for net zero

Current investment is still a drop in the ocean

The chart highlights the scale of the challenge for progressing green finance in the key themes from the Green Finance Strategy. Each theme requires much greater levels of investment in order to reach net zero, and shows the role of public funding to help facilitate and encourage that spending. Likewise between sectors, the strategy commitments in biodiversity and woodland carbon are dwarfed by the commitments to carbon capture.

These funding commitments raise a number of considerations in terms of existing investment and the scale needed within the green finance space. Click on any of the themes below to explore in more detail, including information on the commitments and some of the challenges.

-

Commitment: £20 billion

Consideration: With the largest CCU plant in the UK costing £20 million to build, this funding could cover 1,000 plants of this size- at a capacity of 40,000 tonnes per year each, this only reduces UK carbon emissions by 10% (400 Million tonnes CO2e were emitted by the UK in 2020) [3].

-

Commitment: £30 million of seed capital provided through the Big Nature Impact Fund. Aiming to mobilise £500 million per year in private sector investment.

Consideration: The introduction of mandatory Biodiversity Net Gain for all developments is expected to create a starting market of £135 million per annum, with 6,200 off-site units being required [4]. Government subsidies would cover less than 25% of the cost to land owners to create these units for just one year’s supply.

-

Commitment: £50 million invested in the Woodland Carbon Guarantee scheme to guarantee price for verified carbon credits.

Consideration: The last round of applications had an average guaranteed price of £19.71 [5]. At this rate, 2.54 million credits could be financed with £50 million. 80 million allowances are available for auction in 2023, meaning merely 3% of credits for 1 year will be able to secure such a guarantee.

-

Commitment: £22 billion is available through the UK Infrastructure bank to decarbonise, with £1.2 billion invested so far.

Consideration: Just to handle growth in EV demand over the next 15 years, electricity infrastructure will require a 70% increase in capacity [6]. If this additional power came from new wind farms, it would cost around £42 billion [7]. With the power: infrastructure spend rule of thumb being 55 power : 45 infrastructure [8], another £36 billion investment in the national grid is needed to supply this extra capacity, totalling £78 billion. Bringing online the targeted 114 GW of solar, wind and nuclear energy in the next 30 years will require far more than this.

-

Commitment 1: A further £1 billion is available for home energy efficiency upgrades by 2026, with £6 billion more to be distributed between 2025 and 2028.

Commitment 2: £30 million has been allocated for heat pumps (with a goal of installing 600,000 heat pumps per year by 2028)

Consideration: The home energy upgrades are expected to help improve 133,000 homes annually – taking over 120 years to upgrade all UK homes with an EPC rating of D or below [9]. With heat pump installation currently costing about £7000 for a mid-sized home [10], roughly £4.2 billion per annum will need to be spent to reach this goal. £30 million covers just 10,000 homes, before installation fees are accounted for.

-

Commitment 1: £160 million has been dedicated to the Floating Offshore Wind Manufacturing Investment Scheme

Commitment 2: £240 million to be invested in Net Zero Hydrogen

Consideration: Offshore wind costs £2 million per MW [7]. 80 MW capacity can power less than 1% of the homes in the UK - about 180,000 of 28 million. To hit the 50GW of offshore wind by 2030 target, total investment is expected to be around £74 billion.

The first low carbon hydrogen production facility in the UK is forecast to cost £360 million, with a capacity of 350 MW - this plant is not expected to be fully operational before 2030 [11]. With a national production target of 10GW by that year [12], the government commitment would look to cover 2.3% of the £10.3 billion construction costs needed to cover the entire target. Allowances for planning and approval time would likely push even highly optimistic output forecasts well past 2030.

Real urgency to avoid significant losses

The need for action on climate change is critical, with the Climate Change Committee (CCC) suggesting that additional investment of around £5 billion per year this decade will be needed. If considering all 61 risks and opportunities identified in the UK’s third Climate Change Risk Assessment (CCRA3), this could plausibly rise to £10 billion per year. An additional £50-60 billion capital investment will be required each year throughout the 2030s to reach net zero. The Bank of England also projected £110 billion in additional losses for UK banks out to 2050 in their disorderly transition scenario, and 50-70% higher losses for UK insurers in their highest climate risk scenario.

With many organisations still familiarising themselves with green finance, getting to grips with the new agenda will make the pathway to sustainability clearer and support achieving it faster. To learn more about how Accelar can help you to leverage green finance and make the most of other opportunities presented by the green transition, please get in touch. Alternatively, please create a free account for the Nature Finance Impact Hub to learn how you can create and develop a nature-positive green finance project.